https://finanzasdomesticas.com/estadisticas-de-ahorro

https://finanzasdomesticas.com/estadisticas-de-ahorro can help us understand how well people are saving money. These numbers show us how much people save each month and how they plan for the future. By looking at these estadísticas de ahorro, we can find ways to save more money ourselves.

Estadísticas de ahorro also teach us about different saving habits. For example, some people save a lot, while others save just a little. Knowing this can help us make better choices about how to save our money. Let’s explore how these statistics can help us save better.

What Are Estadísticas de Ahorro

Estadísticas de ahorro are numbers that show how much people save. These statistics tell us about the money people put aside every month. Knowing these numbers helps us see if people are saving enough for their future.

When we look at estadísticas de ahorro, we can find patterns in how people save. For example, some people save a lot, while others save less. By studying these patterns, we can learn how to save better ourselves.

People use estadísticas de ahorro to make plans for their money. If we understand these numbers, we can make smarter choices about saving. It’s important to pay attention to these statistics to help us reach our savings goals.

Overall, estadísticas de ahorro give us a clear picture of saving habits. They help us understand if we are saving enough or if we need to save more. By looking at these numbers, we can improve our saving habits and be more financially secure.

Why Estadísticas de Ahorro Are Important

Estadísticas de ahorro are important because they help us understand saving trends. They show us how people save and what changes might be needed. With this information, we can make better decisions about our money.

Knowing why estadísticas de ahorro matter can help us see where we stand. If we know how others are saving, we can adjust our own savings plans. This helps us make sure we are saving enough for future needs.

Another reason estadísticas de ahorro are useful is that they guide financial planning. By understanding saving trends, we can plan better for big expenses or emergencies. This knowledge makes it easier to set and achieve savings goals.

estadísticas de ahorro are key to managing our money wisely. They give us insights into saving habits and help us make better financial decisions. Paying attention to these statistics can lead to better savings and financial stability.

How to Read Estadísticas de Ahorro

Reading estadísticas de ahorro can seem tricky, but it’s important. First, look at the numbers to see how much people save. These figures show us how saving habits vary between different groups.

When you read estadísticas de ahorro, focus on trends over time. Notice if people are saving more or less. This can tell you if saving habits are changing and help you plan your own savings.

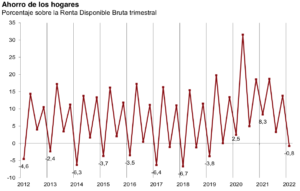

Understanding the details in estadísticas de ahorro also helps. Look for charts and graphs that make the numbers easier to see. These visuals can give you a quick idea of saving trends and patterns.

learning to read estadísticas de ahorro can help you make better savings decisions. By understanding these numbers and trends, you can adjust your saving habits and improve your financial future.

Top Tips for Using Estadísticas de Ahorro

Using estadísticas de ahorro effectively can boost your savings. Start by setting clear goals based on the numbers you see. These goals should be realistic and help you save more over time.

Another tip is to compare your own savings with estadísticas de ahorro. This can help you see where you stand compared to others. It also shows if you need to adjust your saving habits to meet your goals.

Tracking your progress with estadísticas de ahorro is also important. Keep an eye on how your savings grow and if you meet your goals. Regular updates help you stay on track and make necessary changes.

In short, using estadísticas de ahorro wisely can lead to better savings habits. Set goals, compare with others, and track your progress to make the most of these statistics. This approach will help you save more effectively.

Common Mistakes with Estadísticas de Ahorro

One common mistake with estadísticas de ahorro is not updating them regularly. If you don’t keep track of changes, you might miss important trends. Make sure to review your savings numbers often.

Another mistake is focusing only on past estadísticas de ahorro. It’s important to consider current trends and future projections. This helps you stay relevant and adjust your savings plan accordingly.

Ignoring personal factors in estadísticas de ahorro can also be a problem. Your savings goals might differ from general trends. Make sure to tailor the information to your own needs and goals.

To avoid these mistakes, keep your estadísticas de ahorro up-to-date, consider current trends, and adjust for personal factors. This will help you make better saving decisions and avoid common pitfalls.

How Estadísticas de Ahorro Can Improve Your Budget

Estadísticas de ahorro can be a great tool to improve your budget. Start by analyzing your savings data to see where you can cut costs. Use this information to create a more effective budget plan.

Another way estadísticas de ahorro help is by setting realistic budget goals. Knowing how much you typically save can guide you in setting achievable targets. This makes it easier to stick to your budget and reach your goals.

Tracking your budget with estadísticas de ahorro also shows you if you are staying on track. Regular updates help you see if adjustments are needed. This ensures you are always working towards your financial goals.

Overall, using estadísticas de ahorro to improve your budget is a smart strategy. It helps you set realistic goals, track your progress, and make necessary adjustments. This leads to better budgeting and savings.

Understanding Different Types of Estadísticas de Ahorro

There are many types of estadísticas de ahorro that you can look at. Some show how much people save each month, while others look at annual savings. Understanding these types helps you get a complete picture of saving habits.

Another type of estadísticas de ahorro is about savings rates for different age groups. This shows how saving habits change over time. By looking at these rates, you can see how your saving habits compare to others in your age group.

You can also find estadísticas de ahorro that focus on specific savings goals. For example, some may look at how much people save for emergencies or retirement. These types give you insights into different saving priorities.

understanding different types of estadísticas de ahorro helps you see various saving habits. It gives you a broader view of how people save and helps you apply this knowledge to your own savings strategy.

How to Track Your Own Estadísticas de Ahorro

Tracking your own estadísticas de ahorro is a great way to manage your money. Start by keeping a record of how much you save each month. This helps you see your saving habits over time.

You can use tools like apps or spreadsheets to track estadísticas de ahorro. These tools make it easier to record and analyze your savings. Regular updates ensure you stay on top of your financial goals.

Another tip is to set reminders for tracking your savings. This helps you stay consistent and avoid missing updates. Regular tracking allows you to make adjustments as needed.

tracking your own estadísticas de ahorro helps you manage your money better. Use tools, set reminders, and keep records to stay on top of your savings. This will lead to better financial habits and goal achievement.

The Benefits of Analyzing Estadísticas de Ahorro

Analyzing estadísticas de ahorro offers several benefits. First, it helps you understand your saving habits. By looking at these numbers, you can see where you are doing well and where you might need to improve.

Another benefit is identifying trends in your savings. By analyzing data, you can spot patterns and make adjustments to your saving strategy. This ensures you are always working towards your financial goals.

You can also use análisis de estadísticas de ahorro to make informed decisions. Whether you need to save more or adjust your budget, these insights provide valuable guidance. This helps you stay on track with your financial planning.

analyzing estadísticas de ahorro helps you improve your saving habits and make better financial decisions. It offers insights into your saving patterns and helps you stay on track with your goals.

How Estadísticas de Ahorro Help in Financial Planning

Estadísticas de ahorro play a key role in financial planning. They give you a clear picture of how much you are saving and how this fits into your overall financial plan. This helps you plan for future expenses and goals.

Using estadísticas de ahorro in financial planning also helps you set realistic goals. By knowing your saving habits, you can create achievable targets for saving and investing. This makes it easier to reach your financial objectives.

Another benefit is that estadísticas de ahorro can help you adjust your financial plan. If you see trends that suggest you need to save more, you can make changes to your plan. This ensures you stay on track and meet your financial goals.

Overall, incorporating estadísticas de ahorro into your financial planning is essential. It helps you understand your savings, set realistic goals, and make necessary adjustments. This leads to better financial management and goal achievement.

Real-Life Examples of Estadísticas de Ahorro

Real-life examples of estadísticas de ahorro can show us how different people save. For instance, one person might save 10% of their income each month, while another might save more or less. These examples help us understand various saving habits.

Another example is looking at savings trends across different countries. By comparing estadísticas de ahorro from around the world, we can see how saving habits differ. This can provide useful insights for improving our own saving practices.

You can also find examples of how people save for specific goals. For example, some might save for a vacation, while others save for a new car. These real-life examples help us see different saving strategies and goals.

real-life examples of estadísticas de ahorro give us practical insights into saving habits. They help us understand how others save and provide inspiration for our own savings plans.

How to Use Estadísticas de Ahorro for Better Saving Goals

Using estadísticas de ahorro can help you set better saving goals. Start by analyzing your saving patterns to understand how much you typically save. This will give you a baseline for setting realistic goals.

Next, use estadísticas de ahorro to compare your savings with others. If you notice that others are saving more, you might want to set a higher target for yourself. This comparison helps you set goals that are both challenging and achievable.

Another useful tip is to track your progress with estadísticas de ahorro. Regularly update your savings data to see if you’re meeting your goals. This will help you stay on track and make adjustments if necessary.

Lastly, use the insights from estadísticas de ahorro to plan for future expenses. Knowing how much you usually save can help you prepare for big costs, like a vacation or a new gadget. This way, you’ll have a clear plan for reaching your saving goals.

using estadísticas de ahorro effectively can lead to better saving goals. By analyzing your saving habits, comparing with others, and tracking your progress, you can set and achieve realistic financial targets. This approach helps you manage your money wisely and reach your saving goals.

How Estadísticas de Ahorro Impact Your Financial Health

Estadísticas de ahorro have a big impact on your financial health. By tracking how much you save, you can get a clear picture of your financial situation. This helps you understand if you are on track for your long-term goals.

Good financial health relies on understanding your estadísticas de ahorro. If you notice that you are saving less than you should, you can make changes to improve. For example, you might cut back on unnecessary expenses to boost your savings.

Estadísticas de ahorro also help in planning for unexpected expenses. If you have a clear idea of how much you save regularly, you can create an emergency fund. This fund will be helpful in case of sudden costs, like car repairs or medical bills.

Overall, analyzing your estadísticas de ahorro is essential for good financial health. It helps you see your saving patterns, make improvements, and plan for future needs. Keeping track of these statistics ensures that you are managing your finances effectively.

How to Interpret Estadísticas de Ahorro for Better Saving

Interpreting estadísticas de ahorro is crucial for improving your saving habits. Start by looking at the overall trends in your saving data. This will help you understand if you are saving more or less over time.

Next, break down the data into smaller parts. For instance, analyze how your savings vary each month. This detailed look helps you identify patterns and make better decisions about your saving strategy.

You should also compare your data with general saving trends. Seeing how your savings stack up against others can give you a sense of whether you need to adjust your goals. This comparison can motivate you to save more effectively.

interpreting estadísticas de ahorro helps you make informed decisions about saving. By analyzing trends, breaking down data, and comparing with others, you can improve your saving habits and reach your financial goals.

The Role of Estadísticas de Ahorro in Financial Planning

Estadísticas de ahorro play a key role in financial planning. They provide essential information about how much you save and how this fits into your financial plan. This data helps you create a budget that works for you.

In financial planning, estadísticas de ahorro help you set and adjust your savings goals. By understanding your saving habits, you can set realistic targets and make adjustments as needed. This ensures you are working towards your financial objectives effectively.

Another important role of estadísticas de ahorro is to guide your investment decisions. Knowing how much you save can help you decide how much to invest in different areas. This ensures your investments align with your financial goals.

Overall, estadísticas de ahorro are crucial for effective financial planning. They help you set goals, adjust plans, and make informed investment decisions. Using this data leads to better financial management and success in reaching your objectives.

How to Set Realistic Goals with Estadísticas de Ahorro

Setting realistic goals with estadísticas de ahorro starts by reviewing your current saving habits. Look at your past saving data to understand what you can realistically achieve. This will help you set achievable and practical savings goals.

Next, use your estadísticas de ahorro to create specific targets. For example, if you usually save $100 a month, set a goal to increase it gradually. This step-by-step approach helps you reach your goals without feeling overwhelmed.

Also, regularly review your progress to ensure you are on track. Adjust your goals if needed based on your saving patterns and any changes in your financial situation. This flexibility helps you stay realistic and motivated.

setting realistic goals with https://finanzasdomesticas.com/estadisticas-de-ahorro involves understanding your current habits, setting specific targets, and reviewing your progress. This approach helps you achieve your savings goals and manage your money effectively.

How it Help with Emergency Funds

Estadísticas de ahorro are very useful for building an emergency fund. By tracking your savings, you can determine how much you need to set aside for unexpected costs. This helps you prepare for emergencies and avoid financial stress.

To build an emergency fund with https://finanzasdomesticas.com/estadisticas-de-ahorro, start by analyzing your saving habits. Determine how much you can regularly save and set a target amount for your fund. This target will guide your savings efforts and ensure you have enough for emergencies.

Regularly reviewing your https://finanzasdomesticas.com/estadisticas-de-ahorro is also important for maintaining your emergency fund. Make sure your savings are growing as planned and adjust your contributions if needed. This helps keep your fund healthy and ready for any unexpected expenses.

using https://finanzasdomesticas.com/estadisticas-de-ahorro helps you build and maintain an effective emergency fund. By tracking your savings, setting targets, and reviewing progress, you can ensure you are well-prepared for unexpected financial needs.

Using it to Improve Savings Strategies

Estadísticas de ahorro can help you improve your savings strategies. Start by analyzing your current saving habits to see what works and what doesn’t. This analysis helps you identify areas for improvement and adjust your strategies.

Another way to use estadísticas de ahorro is by setting new savings goals based on your data. If you find that you are saving less than you planned, create strategies to increase your savings. This might include cutting expenses or finding additional sources of income.

Regularly updating your estadísticas de ahorro helps you track the effectiveness of your strategies. This ongoing review allows you to see if your changes are working and make further adjustments if needed. It ensures that your savings strategies remain effective.

Overall, using https://finanzasdomesticas.com/estadisticas-de-ahorro helps you refine and improve your savings strategies. By analyzing your habits, setting new goals, and regularly reviewing your progress, you can enhance your saving efforts and achieve better financial outcomes.

The Impact of it on Long-Term Savings

Estadísticas de ahorro have a significant impact on long-term savings. By understanding your saving patterns, you can make informed decisions about your financial future. This knowledge helps you plan for big goals like buying a house or retirement.

Long-term savings benefit from analyzing https://finanzasdomesticas.com/estadisticas-de-ahorro because it allows you to set realistic targets. Knowing how much you typically save helps you create a plan for accumulating wealth over time. This makes long-term goals more achievable.

Another benefit of using https://finanzasdomesticas.com/estadisticas-de-ahorro is that they help you track progress towards your long-term goals. Regularly reviewing your saving data ensures that you are on track and making necessary adjustments. This keeps you focused on your future financial plans.

https://finanzasdomesticas.com/estadisticas-de-ahorro are crucial for successful long-term savings. They help you plan, set realistic targets, and track progress towards your goals. Using this information ensures that you are working effectively towards your financial future.

Conclusion

Understanding https://finanzasdomesticas.com/estadisticas-de-ahorro is really important for managing your money well. By keeping track of how much you save and using this information, you can set better goals, plan for the future, and make smart financial choices. Whether you’re saving for a special toy or planning for something big, knowing your saving patterns helps you stay on track.

using https://finanzasdomesticas.com/estadisticas-de-ahorro helps you get a clear picture of your finances. It makes saving easier and more effective, helping you reach your goals. So, keep an eye on your savings, set goals, and make sure you use what you learn to make your money work for you!